Renters Insurance in and around Indio

Get renters insurance in Indio

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Calling All Indio Renters!

Renting a home comes with plenty of worries. You want to make sure what you own is protected in the event of some unexpected accident or damage. And you also need liability protection for friends or visitors who might stumble and fall on your property. State Farm Agent Guillermo Molina is ready to help you prepare for potential mishaps with dependable coverage for your renters insurance needs. Such considerate service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Guillermo Molina can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Get renters insurance in Indio

Rent wisely with insurance from State Farm

Agent Guillermo Molina, At Your Service

The unpredictable happens. Unfortunately, the valuables in your rented property, such as a TV, a tool set and a desk, aren't immune to burglary or accident. Your good neighbor, agent Guillermo Molina, has a true desire to help you evaluate your risks and find the right insurance options to insure your precious valuables.

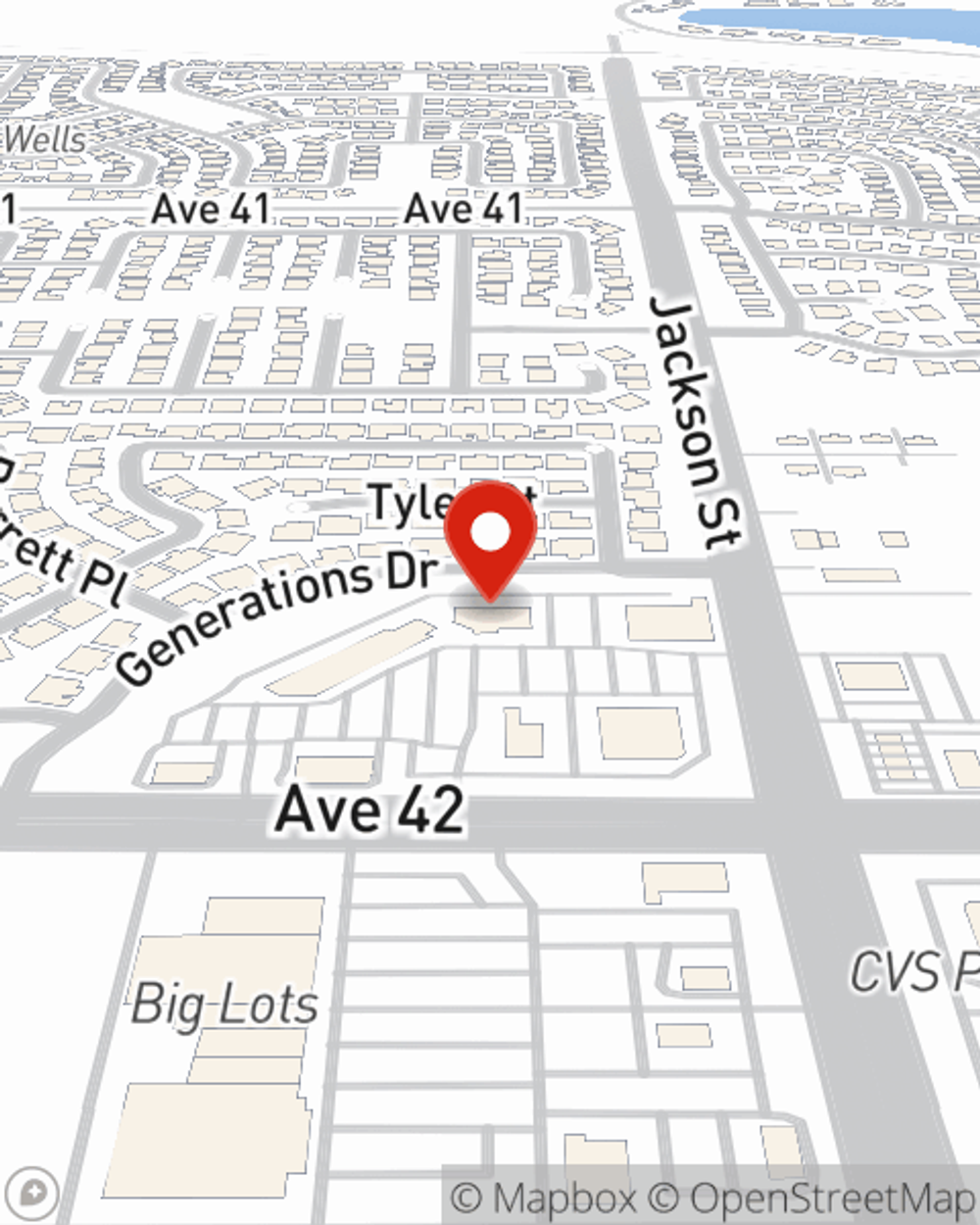

Renters of Indio, State Farm is here for all your insurance needs. Get in touch with agent Guillermo Molina's office to learn more about choosing the right savings options for your rented space.

Have More Questions About Renters Insurance?

Call Guillermo at (760) 347-5700 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Guillermo Molina

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.